Helping Entrepreneurs Win!

Since 2017 we've been dedicated to helping small & under-served entrepreneurs get their business off the ground and make their dreams come true!

We Have More Than 7 Years of Experience

in Business Funding & Credit Services

How to Get Your Credit Reports for Free

Business Funding Form

This quick form helps us learn about you and your business to determine whether we can help!

Message and data rates may apply. Reply STOP to opt out.

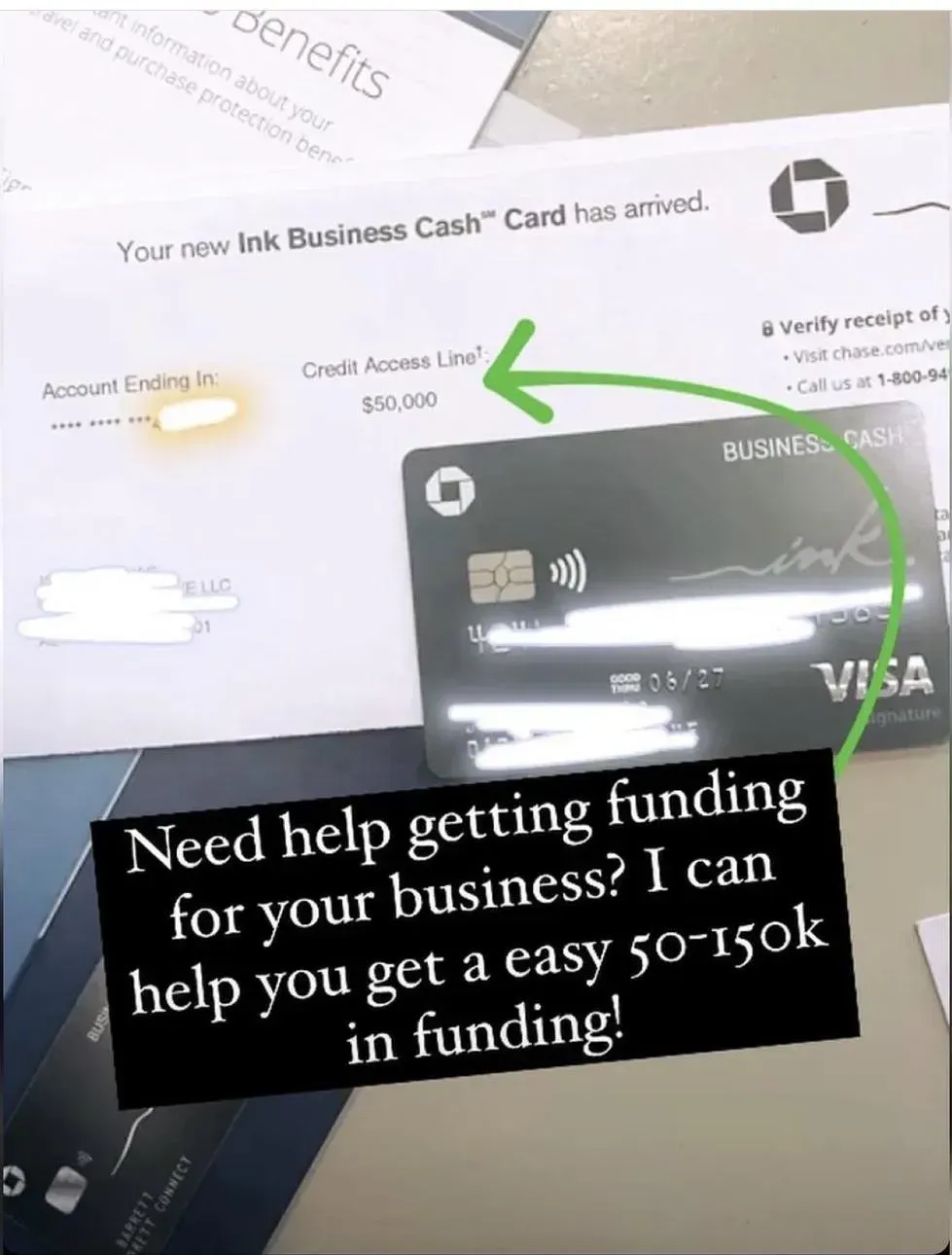

Check Out The Limits We Been Getting Our Clients!

How It Works?

Step 1 - Form & Review

To start our business funding process you will need to submit our Business Funding Form. Our team will review your information and profile.

Step 2 - Qualifying & Set-Up

After qualifying we'll teach you the funding data points needed for high limit approvals and give you access to our strategic banking relationships.

Step 3 - Approval!

Once you're approved, you'll receive your funding and we'll help teach you how to leverage your funding and liquidate your new business credit to cash.

FAQ's

How Long Does It Take?

The average funding process takes 21 - 30 days (Including initial profile review)

Will this hurt my credit score?

We do not run any credit checks until you're ready to be funded. We do require our clients to upload their credit reports so we can manually review them.

What if I'm not approved?

Since we check your credit worthiness manually, there will be no hits or hard inquires on your report. If you do not qualify, we also offer credit repair/building services to clean up your profile, remove negative items, and get you back on track!